"Smart Growth" and "New Urbanism" Compared with "Large Lot Zoning" (Tom Lane) [ Home Page – Click Here]

(May 17, 2017) – Traditional "Large Lot Zoning" is "Greener" than "Smart Growth" within Urban Growth Boundaries . . . Copyright 2009 – 2017 . . . Tom Lane . . . Photographing California, Arizona, Nevada, New Mexico, Colorado, Utah, Oregon, and Seattle, Washington.

(Updated Dec. 25, 2010) Baby Boomers, Young Singles, and Entrepreneurs Move to Bend and other High Desert College Towns

Above: Durango, Colorado at 6500′ (between the high desert and forests in the San Juan Islands), home to Fort Lewis College, attracts baby boomer retirees, young singles, and young entrepreneurs in new condos, such as Skyridge pictured above.

(Most Recently Updated Dec. 25, 2010.)

In searching papers on-line, I always try to find examples of economic expansion, and it’s not easy in smart growth towns. Often, success stories of economic growth and pro-business tax policies are in Bend, Oregon, and other high desert places where both active young singles and baby boomers both move in.

However, of course, Bend does have an urban growth boundary, and resulting major issues, including 14% unemployment, massive foreclosures, and a state Land Commission adversarial to Bend’s interests, with a failure of State Land Chief Richard Whitman to approve the City of Bend’s Urban Growth Boundary extension.

"Baby Boom Migration and its Impact on Rural America," John Cromartie and Peter Nelson, USDA and Middlebury College. CLICK for PDF: http://www.ers.usda.gov/Publications/ERR79/

But one factor will not change – baby boomers will continue to migrate to areas similar to Bend and areas similar to Bend, according to Geographers John Cromartie and Peter Nelson of the USDA Economic Research Service and Middlebury Conference, respectively. They found that the primary reasons for baby boomer migration to rural and exurban areas, such as Bend in our example, include: high quality of life, lower housing costs, an abundance of second homes, and of course, scenic natural amenities combined with an urban environment.

Deschusets County (Bend) has grown by 40% from 2000-2008, similar to Durango, and also the Auburn-Placerville area, below Lake Tahoe in California, and Kittitas County, Washington (high desert 80 miles east of Seattle). This is well ahead of the anti-growth and very expensive Cities of Flagstaff, Boulder, Eugene, Albuquerque, Santa Fe, and Ashland-Medford, and below the growth seen in Pinal County, Arizona, south of Phoenixas reported in this Microsoft Excel Table of every county in the USA by the Daily Yonder’s Bill Bishop (“where everything is rural”).

Overall, the USDA Geography professors calculate that the percentage of people ages 55-75 in rural areas will grow by 30% between 2009 (when the report was written) and 2020. That’s an impressive increase of 5.6 million persons aged 55-75, in small towns and rural areas across America, from 8.6 million in 2000, to 14.2 million in 2020.

This shift from cities to selected rural areas reflects a preference for natural amenities, cheap housing, and the fact that individuals are no longer tied down to careers in large Cities (neither are their children still in school).

Therefore, Cities such as Bend who continue to allow growth, will be at an economic advantage in attracting the big city exodus of baby boomers, compared to anti-growth cities such as Flagstaff, Boulder, and Eugene.

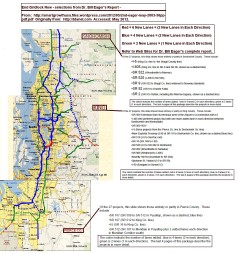

You can see photos of Bend on this web site in numerous posts, by way of the archive page for Bend: Here are some photos of growth in Kittitas County, Washington, 80 miles east of Seattle on the high desert. Interstate 90 is widening to six lanes to accomodate the recent 40% deacadal increase in housing units:

I-90 Construction Sign from 4 to 6 lanes, at rest area east of Snoqualmie Pass, and betwen Cle Elum and Ellensburg. CLICK to magnify and enlarge and read text.

Right side of the aforementioned I-90 Construction Sign from 4 to 6 lanes. CLICK to magnify and enlarge and read text.

The granitic Stuart Range is the background from much of Kittitas County, including the cities of Ellensburg and Cle Elum. CLICK image to enlarge and read text. Sign at the aforementioned rest area on I-90.

The Kittitas Valley, Stuart Range, and Ellensburg with surrounding farming communities. Note sagebrush scrub and grasses at lower elevations, with Ponderosa Pines on the foothill summits.

New housing in Ellensburg, Washington, a college and farming city with Central Washington University ("The Wildcats"), known for high quality undergraduate education with smaller class sizes.

Wind turbines along the Washington / Oregon border near Goldendale and the Columbia Gorge, visible from US-97..

Homes in Maupin, Oregon, between Bend and the Columbia Gorge, along the Deschusets River flowing north to the Columbia (photo from US-197).

Construction on US-97 going south into Klamath Falls, Oregon. Not sure what's going on. Perhaps a passing lane?

Anti-Growth Towns – Recipe for Drugs and Crime?

Why is it always the usual suspects, and their high rents, high cost of living, slow housing growth, slow job growth, transients, and metheads? Is all this from anti-growth, anti-job policies? For example, in Eugene at the University of Oregon, officials are creating a new fully armed police force due to Property Crimes from non-students (these blue article links are from the Sunday August 29, 2010 Eugene paper). UO will become the only University in Oregon with a fully armed police force, according to the article.

_________________________________________________

But I digress. Let’s continue with my opening to this post, the good news. Places like Bend, Durango, and Kittitas County are pro-growth. Dr. William Fruth’s January 1, 2010 Policom study of Economic Strength ratings of hundreds of metro areas, both metropolitan and micropolitan. Among 366 metropolitian areas (versus smaller micropolitan areas), Bend scored very high, at 43. This even beats Boulder, at 87!

Bend rivals other Western medium size markets, such as Boise at 37; Reno at 41; San Luis Obispo at 49; and Santa Fe, NM at 57.

Other Oregon medium sized cities did terribly. Medford at 120; Eugene at 175; Salem, the Capital, at 212; Corvallis, OR. at 270.

Elsewhere out west, Flagstaff was way down at 175; Santa Cruz 133; Lake Havasu-Kingman 217; Prescott 248; and Las Cruces, NM at 274.

Bend Recruits Entrepreneurs with Prestigious National Conferences

Despite the State of Oregon’s antagonism of the City of Bend’s economic development efforts, the City continues to maintain an entrepreneurial atmosphere, by sponsoring a variety of pro-growth initiatives.

Recently in 2010, the City sponsored the conferences Bend WebCam and Ignite Bend. A second Ignite Bend is a few weeks away, in early February. According to the web site for Ignite Bend:

“Ignite goes global—from February 7-11, 2011, 50+ Ignites will take place in cities around the world. Upwards of 10,000 entrepreneurs, technologists, DIYers, creative professionals, and enthusiastic knowledge-seekers will gather in local pubs, theaters, and other convivial venues for an evening that is a unique blend of networking, information, and fun, encapsulated in the Ignite motto: “Enlighten us, but make it quick.”

How many of the 10,000 will come to Bend?

Here are ads in the September 23, 2010 “Source Weekly” (of Bend) for the two conferences:

Mass Merchandisers Optimistic about Central Oregon Expansion

As reported below by the Bend Bulletin (August 28, 2010), Bend mass merchandisers remain optimistic, and have expansion plans on the table.

In addition, the paper discusses the Bend Venture Conference in October, where entrepreneurs and potential investors from Central Oregon and the Pacific Northwest will meet.

A wide variety of types of businesses announced plans to expand in Bend, and elsewhere in Oregon, at the Sunriver resort sponsored conference, entitled Pacific Northwest Idea and Exchange, from the International Council of Shopping Centers:

For example: Wallmart, AutoZone, Rite Aid, Chase and Umpqua banks along with Fred Meyer (this is a smaller, unionized version of Superwallmart with Kroger foods, household items, and it’s the largest private employer in Oregon, see distribution map below.)

Others include Big Lots, Burger King, Chipotle Mexican Grill, Great Clips, Grocery Outlet, Interdent, McDonald’s, Panda Express, Pamera Bread, Rite Aid, Ross (Clothing), Rue21, Sally Beauty, Subway, Starbucks, and Kohls (for Kohls new store, see this seperate link at Bend’s newspaper).

(While I do not see Performance Cyclery listed, bicyclists in Bend will pray that they will never, ever arrive anywhere in Central Oregon with low quality GT bikes! )

The Kroeger Family. From: http://www.fredmeyermastercard.com/about-us/the-kroger-family.asp

Map is from an old Press Release from Kroger in 1998. I cannot verify if this info is accurate in 2010. I have never seen a Fred Meyer (basically, a mini-Wallmart, with a full food section) in Nevada, New Mexico, or Arizona, and suspect that Smiths

However, despite the conference, not everyone is 100% optimistic about Bend’s future. Bill Smith, managing partner of the Old Mill District in Bend, stated to The Bulletin that high costs of regulations in Oregon are an “impediment to development and economic recovery.” However, echoing the USDA Geography study on baby boomer migration cited above, Smith still says that Bend will come back, due to Bend’s natural amenities and high quality of life.

Furthermore, Smith said that Bend’s isolated location prevents customers from driving to other metro areas, such as Eugene and Portland. Interestingly, the Geographers found that baby boomers are increasingly migrating to non-metro counties (i.e. Bend’s county, Deschusets), that do not border Metro counties (i.e. Oregon counties around Portland and Vancouver, Wa.).

And, of course, some Bend retailers are cheaper than Portland or Eugene. Central Oregon car dealers take customers from the Willamette valley, for both sales and repairs.

Retailers, banks scouting region

Despite Central Oregon’s battered economy, companies look to expand

By Ed Merriman / The Bulletin

Published: August 28. 2010 4:00AM PST

The recession has been the worst of times for many businesses, but representatives of AutoZone, Fred Meyer, Rite Aid, Chase and Umpqua banks and others attending the International Council of Shopping Centers conference Thursday at Sunriver Resort talked about expanding and looking to make deals for sites in Central Oregon and other areas of the state.

“We have weathered the downturn in the economy better than most,” said Donald Ehlers, real estate development manager for AutoZone. “People are holding onto their cars longer and doing more repairs themselves. That means there are more of our kinds of vehicles on the road.”

“We’ve had positive sales increases for the last couple of years. We open stores every day of the year,” Ehlers said.

In the Bend area, the company has one store on Third Street, and is considering adding a second store in another part of town, Ehlers said.

“We do have another trade area in Bend. We could do a second store, but we haven’t decided where that other store would best be located,” said Ehlers, who handles real estate transactions for AutoZone sites in Oregon and Washington.

Since the acquisition of Washington Mutual Bank in 2008, Chase Bank is looking to expand with new branches in Oregon and Washington, including Central Oregon.

“The company is growing 150 branches here in the Pacific Northwest,” said Greta Pass, vice president, market director of real estate for Chase. “We’ve got huge growth plans here in Oregon.”

With plans to double Chase’s portfolio in Oregon, Pass said the bank is looking for buildings and property to open new branches in the Portland area, along the Interstate 5 corridor, Medford, Central Oregon and other areas.

“We’re looking for 1- to 1½-acre properties, preferably on high-traffic corners,” Pass said.

The ICSC Pacific Northwest conference, dubbed Idea Exchange, drew attendees to Sunriver Wednesday and Thursday. In addition to AutoZone and Chase, other retailers spoke about their expansion plans or interest in potential locations for new stores or branches, including Big Lots, Burger King, Chipotle Mexican Grill, Fred Meyer, Great Clips, Grocery Outlet, Interdent, McDonald’s, Panda Express, Panera Bread, Rite Aid, Ross Stores, rue21, Sally Beauty, Subway, Starbucks and Umpqua Bank.

“We have come through the recession pretty well. We have done good,” said Ray Davis, president and CEO of Umpqua Bank, which is based in Portland and operates six branches in Bend.

“We’ve got the capital and earnings to expand, and we are planning to add 10 to 12 locations in the next 12 months,” Davis said. “Right now we are adding banks in the Puget Sound area, Portland and San Francisco. Eventually we will add something on the east side of Bend,” Davis said.

Umpqua also is considering expanding into Redmond in the future,” he said.

Frank Wyman, with Rite Aid, said he is looking for sites to expand in Central Oregon,

“We do have a deal-making table” at the conference, Wyman told real estate agents attending Thursday’s meeting.

Don Wirth, with the Fred Meyer real estate department, said the company, which recently took over the title of the largest private employer in Oregon, adds about three new stores a year, and Central Oregon is one of the areas where the company is considering expanding. It operates one store each in Bend and Redmond.

Currently, Fred Meyer is opening a new store in Wilsonville, and construction workers broke ground in July on a new store in Eagle, Idaho, Wirth said.

A city with strengths

Bill Smith, managing partner of the Old Mill District in Bend, said the privately funded public trail system that runs through the district along the Deschutes River, along with the decision by Regal Entertainment Group to locate its theater in the heart of the Old Mill, helped attract customers and many of the roughly 75 retail businesses to the area.

To help businesses survive the down economy, the Old Mill lowered rents, Smith said.

While he cited the high costs of regulations in Oregon as an impediment to development and economic recovery, Smith said he’s confident Bend’s economy will bounce back because it still has great tourism potential, excellent recreational opportunities and high quality of life.

The community’s relatively isolated location, which keeps most locals from driving to Portland, Eugene or other metro areas to shop, also has helped sustain area businesses, Smith said.

Matthew Martinez, of Commercial Realty Advisors Northwest in Portland, said that “with the down economy in the real estate world, you have to show up at these events to let people know you are still alive and kicking. I look around and see other people who are fighting the same battles we are.”

Coming out of the recession, Martinez said his clients, including Wal-Mart, Chase Bank, Great Clips and others haven’t stopped looking for sites to build new stores in places like Central Oregon.

“Chase has about three sites in the Bend-Redmond area,” Martinez said. “I am going to be here finding additional sites for them.

“Yeah, the economy is down a little bit with 15 percent unemployment, but there are too many good things about this area for it to stay down long,” Martinez said.

While many of the real estate professionals were looking to make a deal to sell property in the Bend area to the retail giants attending the conference, others, including Alesha Shemwell, senior leasing manager with Macerich, of Redmond, Wash., were pitching sites in shopping centers in Portland, Salem and Eugene, along with others pitching sites in malls along the Oregon Coast, from Astoria to North Bend.

Ed Merriman can be reached at 541-617-7820 or emerriman@bendbulletin.com.

_________________________________________________

Conference puts Bend on the map

By John Stearns business editor, / The Bulletin

Published: August 29. 2010 4:00AM PST

The Bend Venture Conference in October is more than a competition among startup companies for $150,000 to $175,000 in investment cash.

It’s also about showcasing the entrepreneurial talent in Central Oregon and the Pacific Northwest, connecting entrepreneurs with potential investors from throughout the U.S., and highlighting Bend as a place to do business.

It dovetails nicely with Economic Development for Central Oregon’s new venture catalyst program to nourish early stage local companies by helping them connect with the expertise and investors they need to grow — ideally into big job-generators, said Scott Larson, who manages the program.

This region needs more jobs, especially well-paying ones more immune to cycles that can devastate industries like construction. That’s why Larson’s work and the conference-generated connections companies from this area can exploit are so important.

There are myriad innovative startups in Central Oregon — particularly in the areas of renewable energy; IT software; medical technologies, devices and software; and aviation — that with the right business plan and connections could become the next PV Powered or G5 Search Marketing, Bend companies that have grown into major success stories.

In Larson’s eight months on the job, he’s met with about 140 startups in those primary sectors, which underscores the entrepreneurial activity here. They’re companies for which he works to be the “nurturer and connector.”

PV Powered emerged from the first BVC in 2004 — before the winner got a cash prize — as the best investment opportunity. This year, Advanced Energy bought PV Powered in a deal worth up to $90 million that will keep PV in Bend.

G5, whose software is used for marketing its customers’ websites on search engines and has grown significantly, just secured a $15 million investment.

“That is the largest venture capital investment of the year in Oregon and it happened in Bend,” Larson said. “That alone is just a critical message to deliver” about the kind of activities happening in the region, he said.

The BVC helps to do that.

Dan Hobin, co-founder and CEO of G5 and who co-founded the BVC to create a type of startup ecosystem in Bend, said the climate for the conference is better today than in 2004.

“The environment globally or nationally for startup companies and getting funding is much better,” he said, noting the many interesting companies forming in areas like social media and clean technology, including many in Bend. Hobin expects more Bend companies to qualify for BVC’s investment contest and “you might even see a Bend company win it,” he said. The last three winners were from outside Central Oregon.

The BVC prides itself on attracting early stage companies from throughout the Northwest, which explains its attraction to angel investors and venture capitalists from the Northwest and beyond, said Ruth Lindley, marketing manager for EDCO, which is managing the BVC. “(BVC’s) purpose is to showcase local entrepreneurial ideas … but we don’t want to be so parochial that we’re only open to a local winner,” she said.

Often, startup companies make critical contacts at the BVC whether they’re chosen to present their business plans to the investment panel or not, Lindley said.

Bruce Juhola, who helped with the BVC early on and is managing member of 2010 BVC Investor LLC, whose members provide the investment money to the conference’s winning company, said the event has proved successful.

“We really wanted to put Bend on the map as a place for startups and entrepreneurs — it’s really been paying off,” he said, noting the new companies that have started in or moved to Bend in recent years. “That was our primary objective and I think we’ve achieved that.”

Juhola is still accepting LLC investors. The minimum unit purchase price is $5,000. He’s confident the prize pool will exceed $150,000 and seeks $175,000. For information on investing, contact him at 541-420-2534 or at bmjuhola@cmc.net.

For more on BVC, scheduled Oct. 14-15, visit http://www.bendvc.com. Investors and qualifying startups shouldn’t miss it.

John Stearns business editor, can be reached at 541-617-7822 or at jstearns@bendbulletin.com

______________________________________________________

Bend Hotel Fiscal Year Revenue Increase, 2009-10, Beating Aspen, Boulder, and Flagstaff

While Bend had just a 1% increase in hotel taxes for the fiscal year ending June 30, 2010, other Western US mountain and tourist towns decreased substantially.

In fact, Bend taxes were forecasted to drop by 14.5% for the fiscal year. Aspen, Colorado hotel taxes went down 9%, and Steamboat Springs, Colorado taxes went down 15%. Flagstaff, Arizona hotels down 2.7%.

These data are from RRC Associates in Boulder, Colorado, as quoted in the newspaper article below.

Overall, Oregon was down 3%, and the US down 4%. Even the normally prosperous Boulder, Colorado was down 5%. Sunny Florida down 2%, and Hawaii down 4.5%.

6% in California and Washington, and down 11% in Las Vegas.

Bend can and will use these results – even just a 1% increase – to boost its tourism image. Bend offers four seasons of high quality outdoor recreation, as show in this Bend Bulletin newspaper recreation guide, in a high desert landscape with mountains, rivers, fishing, hunting, lakes, Ponderosa Pines, and sagebrush.

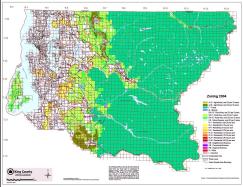

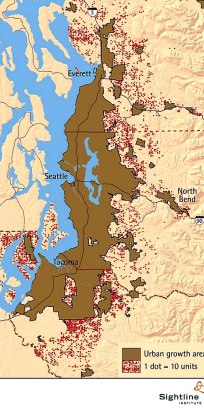

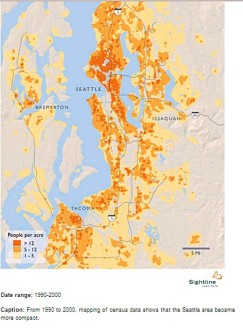

Why did hotel taxes not decline in Bend? I would offer a growth management hypothesis. Unlike many mountain/outdoors towns who have restricted growth over recent years such as Flagstaff, Arizona, and Boulder, Colorado, Deschusets County (Bend) has experienced rapid growth of approx. 40% in housing units from 2000-2008, according to the US Census (and reported by Bill Bishop in his .pdf file here). As you can see from Bill’s map below (from his article), dark green counties have grown at fast rates in the 2000’s, such as Deschusets County in Oregon:

This map is from “New Housing Increases Fastest in the Exurbs,” by Bill Bishop in The Daily Yonder, http://tiny.cc/8wldk Accessed August 10, 2010.

Despite the Bend foreclosure disaster, could tourism and retiring baby boomers ultimately propel Bend to success?

Does recent rapid growth over the past decade or two have any relationship to tourism in 2010?

For Bend to succeed, many things must happen. Of critical importance is for Richard Whitman to either approve the City of Bend’s urban growth boundary increase, or, be replaced as Oregon’s Land Chief.

Tourism trends look promising

By John Stearns business editor, / The Bulletin

Published: August 22. 2010 4:00AM PST

It’s hard to find much to cheer about these days in business. An exception: the last seven months of room-tax data from Bend’s tourism agency, Visit Bend.

Room-tax collections, the best indicator of tourism activity, rose from December 2009 through June 2010, versus the same months a year earlier. While July data is not out yet, “early indications are that July 2010 was a very strong month, and we are projecting double-digit growth” over July 2009, Visit Bend President and CEO Doug La Placa said.

Some of those gains can be attributed to events, such as national bike races, the agency has landed. Listening to Tuesday’s Visit Bend board of directors meeting, I was impressed by the dozens of events — mostly athletic — Visit Bend has secured, or is trying to secure, through 2014.

It’s trying to land events that match with Bend’s lifestyle, bring competitors and their families here to fill hotels and restaurants and introduce the area to new faces. It seems to have struck a productive vein.

Visit Bend’s website also is getting bombarded with hits, seemingly indicating interest in visiting the city.

July’s website traffic rose 55 percent over July 2009, to 51,947 unique visitors, according to Lynnette Braillard, marketing director. June was up 42 percent, and August is tracking about 70 percent ahead of last year at this time, she said.

The site’s also driving significant traffic to other websites, like those for the Old Mill District, the Downtown Bend Business Association, Wanderlust Tours and the local Marriott hotel sites, representatives of those organizations said. For the Old Mill, about 85 to 95 percent of all website visitors come from the Visit Bend site, said Noelle Fredland, Old Mill marketing director and Visit Bend board member.

With current trends, Visit Bend is projecting a 4 percent increase in room-tax collections in the fiscal year that began July 1 over the year ended June 30. That year saw a 0.8 percent increase. The agency had forecast a 14.5 percent drop.

One percent may seem puny, but consider that estimated room-tax collections in Aspen and Steamboat Springs, Colo., for example, were down 8.9 and 14.9 percent, respectively, according to RRC Associates of Boulder, Colo. Also, compare that with estimated declines in hotel room revenue of 2 percent in Florida, 2.7 percent in Flagstaff, Ariz., 3.2 percent in Oregon, 4.3 percent in the U.S., 4.5 percent in Hawaii, 5.3 percent in Boulder, Colo., 5.6 percent in California, 6.4 percent in Washington, and 11.1 percent in Las Vegas, per Smith Travel Research figures provided by RRC.

In other data released last week, 15 mountain destinations, including Bend, participating in the Mountain Travel Research Program saw sharp increases in July occupancy and also are seeing increases in their advance reservations outlook for the next few months, according to a news release. Data are from a sample of 265 property management companies representing 24,000 rooms in Colorado, Utah, California and Oregon, where Bend is the only player.

“It appears that some market sectors are being dragged down by a fresh wave of economic concerns, but travel in general and mountain travel in particular is showing continued strength,” Ralf Garrison, founder and director of the Denver-based Mountain Travel Research Program, said in the release. The summer business is gratifying, but he cautioned “it’s too early to be overly confident about the upcoming ski … season since the economic recovery is still sputtering and mixed messages make future predictions uncertain.”

Amy Reynolds, general manager of the Marriott hotels in Bend, TownePlace Suites and the Fairfield Inn & Suites, said 2010 is definitely better than 2009.

“The … encouraging thing to me is that we’ve seen more travelers in 2010 than we did in 2009; it’s just that the (room) rates are lower because of the economy,” Reynolds said, hopeful that continued occupancy growth will push up rates. Events help to generate that occupancy, creating “compression” in rooms citywide. “It just looks like there is a lot that is going to be booked for the next few years,” she said of Visit Bend’s event focus.

Numbers indicate Visit Bend’s on the right track, which bodes well for Bend.

John Stearns business editor, can be reached at 541-617-7822 or at jstearns@bendbulletin.com.

________________________________________________

Bend Defers Impact Fees

Given their 15% unemployment, Bend deserves recognition for its recent pro-business, economic stimulus policies, with no Impact Fees since 2008! I had no idea there was a place like this! I hope others will follow their lead!

1. Bend voted just last week to extend the program to defer Impact Fees, that began in 2008, for another year (see article below for specifics).

2. They plan to slash Impact fees and other fees for businesses relocating within the City during these tough times, to encourage business retention and expansion.

3. As previously mentioned, they have taken a very professional and courageous approach in challenging Oregon State Land Czar Richard Whitman, over his denial of their urban growth boundary (UGB) expansion plans. See Official City of Bend and State of Oregon Documents at this link: http://tiny.cc/r9nqt

(Note: The UGB may be the reason for Bend leading the nation in home depreciation, as reported in the last article below. Theoretically, under UGB’s, builders are forced to ration their land, just to stay in business over future years. Without sufficient cheap land within or outside the UGB, the cost of land rises (since it is rationed), and the supply of new homes diminishes, resulting in price increases, housing booms, and subsequent housing busts.

The term “housing bubble” needs to be eliminated in the media. This ignores the economic reality in real estate economics, that a bubble is economically unsustainable and doesn’t grow forever (as many economists and realtors thought it would several years ago).

When housing demand remains constant, yet home prices are increasing and median incomes are stable, then a crash will inevitably occur. Of course, home prices can rise forever in Boulder, San Francisco, and Mammoth Lakes, California, and other Superstar Cities, since the rich outbid each other in these areas. See my post on Dr. Joseph Gyourko and Superstar Cities: http://tiny.cc/7rt88

http://www.bendbulletin.com/apps/pbcs.dll/article?AID=/20100805/ NEWS01/8050412

Bend may help businesses relocate

City Council looks at discounting city fees that come with moving a business

By Nick Grube / The Bulletin

Published: August 05. 2010 4:00AM PST

Bend City Councilors want to launch a pilot program to help small businesses relocate within city limits through a discount on the planning, building and engineering fees associated with moving into a new building.

During a work session Wednesday, councilors for the most part supported the idea of the incentive, and decided they would offer a 50 percent reduction of these fees for up to one year and cap the subsidy at $50,000.

“It seems to me that if I was a small business owner and wanted to move that this would be a benefit to me,” Mayor Kathie Eckman said.

Encourage expansion:

According to city officials, the intent of the discount program is to encourage small business to expand operations and help struggling businesses stay open by helping them move to smaller quarters. It could also help some businesses move to more desirable locations.

Councilor Jodie Barram, however, did not think the program was an effective use of the city’s limited funds at this time, though she generally supported the idea of the program and the effect it could have on improving perceptions of Bend among small business owners.

“I can’t see justifying the expense right now,” Barram said. “Our general fund is in such a state right now with other pressures.”

Costs for the program would come from the city’s general fund, which is facing a $17 million deficit over six years. And without the $50,000 cap councilors chose to pursue Wednesday, city officials estimated the cost for a full year of the discount program could be anywhere from $60,000 to $90,000.

Some councilors looked at the program as a sort of investment, and a way to retain businesses in the area and help them grow. Others said they wanted to monitor how effective the program is to make sure they just weren’t offering a subsidy to businesses that were going to relocate regardless of the whether the discount was available.

“In my mind this is economic development, just trying to boost business and trying to get things moving again,” Councilor Mark Capell said. “To me, my number one thing is, how do we get Bend businesses moving?”

Meeting next month:

Councilors will likely hold a public hearing on the discount program next month, and have a tentative start date scheduled for Oct. 1.

In other action, the council voted unanimously to extend a system development charge deferral program for builders as a means to reduce the initial cost of construction. Individuals normally must pay these fees up front as a way to offset the impacts to the city’s water, sewer and road system, but under the program they are allowed to defer those charges for nine months interest free.

The council also approved findings that will allow to it to hire a construction manager/general contractor to oversee its proposed $71 million overhaul of the municipal water system instead of using a traditional competitive bidding process.

Federal mandates require the city update its aging water supply system — which, in addition to wells, relies on taking surface water from Bridge Creek and piping it into Bend — and add a treatment facility to help kill potentially dangerous organisms, like Cryptosporidium, by 2012. The city’s proposed surface water improvement project includes several complex and expensive components, including a the installation of 10-mile-long pipeline, hydroelectric powerhouse and water treatment plant.

Result in savings:

Bend Public Works officials and an individuals from an engineering firm the city hired, HDR Engineering Inc., contend the CM/GC process is the best way to handle such a complicated project. They have said it could result in cost savings because the CM/GC firm would be involved early in the design phase and could coordinate the various construction components in the most efficient manner.

Councilors also approved increasing the water and irrigation rates of about 700 Juniper Utility customers by 10 percent.

Bend residents could also start to see larger drive-thru menu boards based on another decision the council voted on that will change the city’s sign code. Once enacted this change will allow businesses with drive-thru lanes to increase the size of their menu boards to 45 square feet from previous restrictions of having only one 40-square-feet or two 15-square-foot signs. Drive-thrus with two lanes can have two 45-square-feet signs.

Councilors Barram and Jim Clinton voted against the sign code amendment. A second reading of the amendment is planned for the next council meeting.

Nick Grube can be reached at 541-633-2160 or at ngrube@bendbulletin .com.

http://www.bendbulletin.com/apps/pbcs.dll/article?AID=/20100731/NEWS01/7310359

_________________________________________________

Bend may extend fee deferral

Program allows builder to put off paying development fees

By Nick Grube / The Bulletin

Published: July 31. 2010 4:00AM PST

What: Bend City Council meeting

When: 7 p.m. Wednesday

Where: Bend City Hall, 710 N.W. Wall St., Bend

Bend city councilors will decide Wednesday whether to keep a home-grown economic stimulus program that allows builders to defer paying certain development fees.

In 2008, Bend began offering the program, which allows delayed payment of system development charges for up to nine months without interest, to help reduce the initial cost of construction. These fees are charged to offset impacts to the city’s sewer, water and roads systems.

Results are nothing to write home about

While city officials thought the fee deferral program would encourage more development in Bend, the results so far have been underwhelming.

“It’s not spurring a whole bunch of development,” Bend Finance Director Sonia Andrews said Friday. “The program was to help stimulate economic development and help projects pencil out that wouldn’t have penciled out otherwise.”

According to a report prepared for Wednesday’s City Council meeting, Bend had deferred $303,421 in system development charges for 26 projects since the program started.

This is only one more deferral than what the city reported in June. At that time, almost all of the deferrals were for single-family homes, with one for a light industrial building and another for a commercial structure.

Most deferrals used for residential projects:

Also at that time, two companies, Tennant Developments and Yelas Developments, accounted for 10 of the 25 deferrals — totalling $118,600 — all of them single-family homes.

“We had no idea when we implemented it if it would be commercial developers or residential developers taking advantage of it,” Andrews said. “Right now it’s (almost) all residential.”

Andy High, the vice president of government affairs for the Central Oregon Builders Association, developed the idea for the program.

High said that even though not many developers have taken advantage of the service, he would like the city to continue offering it.

With lending becoming tighter, he said, a deferral of system development charges could make the difference in someone undertaking a construction project because the developer does not have to borrow as much money at the outset.

“Deferring that initial cost during construction could help them a little bit and could help them pull the trigger,” High said. “As we’re coming out of this downturn and seeing things pick up, I think you’ll see more people taking advantage of it.”

While he would like to see the city make the fee deferral program a permanent endeavor, High said a one-year extension is better than nothing.

Not a ‘savior:’

“Do I think it’s a savior to the building industry? No,” High said.

“There’s a lot of things that need to happen, but it helps.”

Councilors have extended the system development charges deferral program once before in 2009.

Nick Grube can be reached at 541-633-2160 or ngrube@bendbulletin .com.

http://www.bendbulletin.com/apps/pbcs.dll/article?AID=/20100804/ NEWS01/8040332

________________________________

Bend may help moving businesses

City councilors also slated to discuss water rates, signs and Juniper Ridge

By Nick Grube / The Bulletin

Published: August 04. 2010 4:00AM PST

If You Go:

What: Bend City Council meeting

When: Today, 5 p.m. work session, 7 p.m. regular meeting

Where: Bend City Hall, 710 N.W. Wall St., Bend

A number of topics will be discussed and potentially decided at tonight’s Bend City Council meeting, including the possibility of raising water rates for Juniper Utility customers, increasing the permissible size and number of signs allowed at restaurant drive-throughs and creating a program to help businesses relocate within the city.

During a work session that begins at 5 p.m., councilors will consider how they want to form a program to help small-business owners move their companies into different buildings, either as a means to save money and stay afloat or to expand.

The City is proposing offering discounts to these business owners on the permits associated with moving into new buildings, and officials are looking for input from councilors on issues such as what companies would be eligible and how much the fee reduction would be.

Juniper Ridge, the city’s proposed 1,500-acre development on its northeast side, will also be discussed during the council’s work session. Councilors will have to weigh the pros and cons of approving the covenants, conditions and restrictions (CC&Rs) for a 264-acre portion of the development where Les Schwab Tire Centers, Suterra LLC and PacifiCorp now own properties.

Juniper Ridge owners association would be formed:

Once adopted, these CC&Rs — which are similar to the guidelines a homeowners association implements in a neighborhood — would form a Juniper Ridge owners association that would oversee how the mixed-use development area would be managed and maintained as it incorporates new businesses. As with other property owners, the city would have to pay an annual assessment to this owners association for administration and maintenance of the common areas.

According to an issue summary for tonight’s meeting, this could lead to the city paying anywhere from $20,000 to $120,000 a year, with an average annual cost of about $85,000.

At the regular session that begins at 7 p.m., councilors will likely make decisions on a number of issues, such as whether to continue a system development charge deferment program for builders and hire a single firm to oversee the many construction components of a proposed $71 million overhaul of the municipal water system that officials say is needed to meet federal mandates.

They will also decide if they want to change the municipal sign code at the request of a local McDonald’s restaurant owner who wants to put more and larger menu signs in drive-throughs to accommodate plans to operate two lanes.

Currently, the city only allows for one 40-square-foot menu board in a drive-through or two 20-square-foot signs. This does not include a provision that allows for one 15-square-foot sign at a drive-through entrance.

The proposed change would allow drive-throughs to increase the size of their signs to 45 square feet for up to two lanes.

The city says such a change would be to help the fast food industry, which is moving toward dual drive-through lanes because sales at drive-up windows have become such a major portion of its overall sales.

Another possible decision councilors will make is whether to increase water and irrigation rates by 10 percent for the approximately 700 Juniper Utility customers. This would increase the typical water bill for those customers from $22.79 to $25.07, and the irrigation bill from $26.44 to $29.08.

City officials say the higher cost of delivering services to Juniper Utility customers than to those in other parts of the city is behind the proposal. The increases also would help the city recover costs associated with maintenance on the system.

If approved, the increases would take effect Aug. 15.

Nick Grube can be reached at 541-633-2160 or ngrube@bendbulletin .com.

_________________________________________________________

Bend Leads the Nation in Home Depreciation –

Cash out of Seattle and San Francisco …

and Go buy Three Homes in Bend

The Bend newspaper reports on August 10, 2010 that Bend leads the nation in home depreciation, with the average value at just $167,000. Bend is now a Buyers market, and a bargain for renters attending Central Oregon Community College and the branch campus of Oregon State University.

From: http://www.bendbull etin.com/apps/pbcs. dll/article?AID=/20100810/NEWS0107/8100373

Bend leads nation in home depreciation

Last modified: August 10. 2010 5:13AM PST

Housing values in Bend have dropped at a higher rate than in any other metropolitan area in the nation during the past year, according to real estate website Zillow.com.

Bend’s median home price fell by 21.8 percent, to $167,500, from the second quarter of 2009 to the second quarter this year. Values have dropped 52.5 percent in Bend since the peak of the market in mid-2006, when the median price was $354,000, according to Seattle-based Zillow.

Bend fell the furthest among Oregon metropolitan areas and has had, since the beginning of 2010, the lowest median home value, according to Zillow. Zillow’s numbers include both single-family homes and condominiums.

Just last week, however, a Bloomberg Businessweek report forecast that Bend would have the nation’s second-strongest housing rebound by 2014, with a 33.6 percent uptick in prices. Only Bremerton-Silverdale, Wash., was picked to rise more, at 44.7 percent.

The housing forecast, done for Businessweek. com by Fiserv and Moody’s Economy .com, was based on factors that included income growth, demographic trends, unemployment and foreclosure rates, and construction costs. It expects Bend’s prices to bottom in the first quarter of 2011, followed by a rapid recovery.

From: "Bend Leads Nation in Home Depreciation," The Bend Bulletin, August 10, 2010, http://tiny.cc/lm352, Accessed August 10, 2010.

___________________________________

Not so good news for Prospective Resort Developer near Sunriver, due to Oregon Restrictions on Local Development

Sunriver, and unincorporated residential resort south of Bend, Oregon, faces a forthcoming neighbor, Pine Forest Development LLC.

However, the approval could take years:

“Developers might have about seven more years to get resorts approved in Deschutes County, based on a population forecast for the city of Bend. That is because state law currently prohibits resorts within 24 air miles of cities with populations of more than 100,000, unless they limit residential uses.

This will eventually make all but the far-flung corners of the county off-limits for new resorts. Deschutes County has the most approved destination resorts of any county in Oregon.

Bend’s population hit 82,280 in July 2009, according to Portland State University’s Population Research Center. The city could reach 100,000 residents by 2016 or 2017, according to a forecast the county produced in conjunction with local cities, Deschutes County’s Planning Director, Nick Lelack, wrote in an e-mail.”

Translation, here, is that new resorts may have to build further than 24 miles from Bend, since Bend’s population may eclipse 100,000 soon.

That means longer commutes of over 24 miles, and more air pollution, as “rich residents” in those resorts commute to Suterra and other high tech companies in Bend, Redmond, and Prineville.

Or, in other words, even more leapfrogging (i.e. longer commutes due to driving over Urban Growth Boundaries, and driving throught unused Agricultural and Forest land).

Remember, of course, that permitting delays cause increased real estate prices, as shown by Real Estate economists Dr. Theo Eicher of the University of Washington, and Dr. Joseph Gyourko of Wharton.

In addition to permitting delays, the hiring of outside consultants can delay project approval. Deschusets County (around Bend) has just hired students from the University of Oregon (Eugene), to study the pros- and cons- of the resorts.

The bill for the student consultants? Up to $40,000! The second article below discusses the study.

However, in this recession, it should be a no-brainer that building more resorts means more construction jobs, more tourism taxes, and less unemployment.

We can’t be “all green, all the time.” There are times when suspected environmental impacts of construction (i.e. excess runoff, increased traffic, etc.) must be temporarily ignored, in order to feed the hungry and house the homeless in recessions.

Furthermore, recessions should bring out the best from all of us, for example, one might establish a tree ordinance that native Ponderosa Pines are preserved during construction. Or, that native grasses and wildflowers are planted along dry washes and in retention basins, instead of gravelscaping.

Of course, as one who is primarily a designer, I take a highly aesthetic approach, and make things as green as possible because it looks nice. That is not the philosophy of many planners and environmentalists, who measure things in terms of carbon credits and greenhouse gas emissions. My view is to plant as many native plants as possible; this will feed an entire ecosystem of insects, birds, and small mammals.

Overall, permitting delays and studies from outside consultants serve as regressive processes. Furthermore, these studies ignore the environmental improvements that occur through community involvement. For example, many of us participate in philanthropic efforts in our communities, such as building mountain bike trails, planting trees and wildflowers, and growing community gardens.

Philanthropic environmental projects, a common theme in this web site, requires enthusiastic newcomers and families for ongoing participation. Communities that face high foreclosure rates and population exodus may have low rates of philanthropic capital improvements, as people leave their community.

Therefore, continuing growth in tourist towns is crucial towards maintaining low unemployment, and environmental quality.

Bend Bulletin paper, July 24, 2010, first of two articles:

Resort map delay worries Sunriver

The resort can’t start years-long process until county makes a move

By Hillary Borrud / The Bulletin

Published: July 24. 2010 4:00AM PST

Owners of a potential resort development near Sunriver are concerned about a delay in the process that would allow some property owners to obtain resort zoning for their properties.

Commissioners are still wrestling with the question of whether to create an exception to allow the Cyrus family to keep resort zoning on a subdivision they developed near Sisters. The current proposal calls for resort zoning to be removed from all subdivisions in the county.

Meanwhile, the window of time for destination resort developers to get their plans approved in Deschutes County could close in the next decade.

From: Bend Bulletin, July 24, 2010, Story: "Resort map delay worries Sunriver The resort can’t start years-long process until county makes a move" http://tiny.cc/7ym94, Accessed August 10, 2010.

The company with the most at stake if commissioners continue to delay the resort zone update or scrap it completely is Sunriver Resort Limited Partnership. It owns 617 acres south of Sunriver through a company called Pine Forest Development LLC, and is interested in building a resort on the land. However, the land is not currently in the county’s resort zone.

At the same time, representatives of a Realtors association and a land use watchdog group called the county’s resort zone update unnecessary.

The county does not yet have a procedure to remove or add land to the zone, Principal Planner Peter Gutowsky wrote in an e-mail. Land use planners began a year ago working on procedures that would allow land to be removed or added to the zone.

Some question remapping:

Several resorts have run into financial difficulties since the housing market crash and development has slowed. Sunriver’s owners are currently the only developers serious about building a new resort, said Erik Kancler, executive director of Central Oregon LandWatch, a local land use watchdog group.

“If you survey the landscape to see who’s serious about a resort in Deschutes County, there’s only one party that’s serious, and it’s Sunriver,” Kancler said.

Sunriver actually functions as a resort community, unlike other resorts in Deschutes County, Kancler said. He believes there is probably a continued market for Sunriver’s brand.

But Kancler questioned why Deschutes County has dedicated its resources to updating the resort zone, when only one developer has expressed interest in getting property added to the resort zone. “My general thought on remapping is, why are we bothering?” Kancler said.

Sunriver Resort Limited Partnership has worked closely with Deschutes County in recent years to develop a new Destination Resort mapping ordinance, attorney Steven Hultberg, who represents the company, wrote in an e-mail.

“We are hopeful that the county will adopt the mapping ordinance in the short term, which would allow the county to proceed with remapping over the next year,” Hultberg wrote in an e-mail Wednesday.

“We are, however, also aware that there appear to be policy differences among the commissioners which may delay adoption. Because this is the first step in a multi-step process, we remain hopeful that the (County Commission) will adopt the mapping ordinance soon so that the county can proceed with remapping on its current schedule.”

By contrast, Bill Robie, the government affairs director for the Central Oregon Association of Realtors, said he originally felt the county should not have tried to update the resort zone map, and instead “let sleeping dogs lie.”

“Destination resorts have become the third rail of land use politics in Central Oregon,” Robie said. “Anytime you go near that, you will create a lot of interest.”

When the county Planning Commission suggested earlier this year relaxing criteria so more land could be zoned for resorts, Robie said he supported the idea, because it would allow for more economic development in the remaining time when new resorts can be approved. But the County Commission mostly rejected the Planning Commission’s recommendations, and Robie said at this point, it would be OK for the county to scrap plans to redo the map.

The commission is scheduled to meet Wednesday to continue deliberating on the issue.

Resort approval could take year:

Developers might have about seven more years to get resorts approved in Deschutes County, based on a population forecast for the city of Bend. That is because state law currently prohibits resorts within 24 air miles of cities with populations of more than 100,000, unless they limit residential uses.

This will eventually make all but the far-flung corners of the county off-limits for new resorts. Deschutes County has the most approved destination resorts of any county in Oregon.

Bend’s population hit 82,280 in July 2009, according to Portland State University’s Population Research Center. The city could reach 100,000 residents by 2016 or 2017, according to a forecast the county produced in conjunction with local cities, Deschutes County’s Planning Director, Nick Lelack, wrote in an e-mail.

Timeline varie:

That might seem like enough time for developers to get resorts approved, but the timeline of the process varies widely, based partly on the amount of opposition.

It took six months for county officials to sign off on plans for Tetherow resort west of Bend in 2005, while it was two years before officials approved Pronghorn resort southeast of Redmond in 2002. Developers submitted plans for Thornburgh resort in 2005, but the resort was caught up in litigation until February, because opponents appealed the county’s approval. Now, resort developers must decide whether to make changes to their application called for by Oregon’s Land Use Board of Appeals and Court of Appeals, in order to proceed.

If the County Commission approves by emergency the procedures to add and remove land from the resort zone, county planning staff could begin the process of doing so in September, Gutowsky said. But if the commission adopts the ordinances by the normal, more lengthy method, planning staff will have to wait until September 2011 to begin working on adding and removing land.

Hillary Borrud can be reached at 541-617-7829 or at hborrud@bendbulletin.com.

http://www.bendbulletin.com/apps/pbcs.dll/article?AID=/20100817/NEWS01/8170390

_________________________________________________

Group to look at resorts’ impact

Deschutes County will pay UO group to study destination resorts

By Hillary Borrud / The Bulletin

Published: August 17. 2010 4:00AM PST

Graduate students from the University of Oregon are going to try to give Deschutes County government more definitive answers about the costs and benefits of destination resorts.

Students from the university’s community planning workshop are scheduled to get their study under way Wednesday with four focus groups: tourism and resort industry representatives; environmental groups; residents who have participated in resort issues; and agencies such as cities and irrigation districts, said county Planning Director Nick Lelack.

Destination resorts have long been a source of contention in the county. They bring in tourists and property taxes but also create a need for roads and other infrastructure that did not exist before. One problem for Deschutes County officials has been that previous studies on the impact of the resorts have been produced by the resort industry, and opponents’ studies, perhaps not surprisingly, have been contradictory.

Deschutes County is going to pay the university’s community planning workshop from $10,000 to $40,000 for the full study, dependent on the level of work performed. The county has already paid $3,500 for the study’s first phase.

The focus groups are supposed to discuss which resort impacts the study should examine — for example, how resorts affect the environment, taxpayers and the local economy. How the first phase of the study unfolds could determine whether different interest groups trust the ultimate conclusions of the study, according to a representative of the tourism industry and the executive director of a land use watchdog group.

Wednesday’s focus groups are only open to people invited by the university’s Community Planning Workshop, Lelack said. There will be public meetings during the second phase of the study.

Lelack expects results of the first phase of the study to be ready by mid- to late September.

Earlier this year, Deschutes County Commissioner Tammy Baney argued for the study of destination resorts, as an answer to contradictory reports on the issue by resort operators and a land use watchdog group.

With a couple of exceptions, most of the research on resort impacts has come from the analyses developers are required to produce to get approval for their projects.

In 2009, consultants for Sunriver Resort and the land use watchdog group Central Oregon LandWatch each completed a report. A regional economist for the Oregon Employment Department also examined average wages for resort jobs, and how much tax resorts and their customers paid, in a 2007 report. Resort jobs paid more on average than other leisure and hospitality sector jobs, but about $10,000 less than average salaries across all industries in 2006, according to the report.

The positive impacts

Sunriver Resort’s 12-page report focused on the positive impacts of the developments. For example, resort owners at Sunriver Resort, Eagle Crest and Pronghorn paid approximately $1.7 million total in property taxes in 2005-06, according to the report.

Central Oregon LandWatch’s 103-page report focused on the county-approved, but as yet unbuilt, Thornburgh resort, planned near Tumalo. The report concluded that the costs of destination resorts outweighed the benefits.

Erik Kancler, executive director of Central Oregon LandWatch, said older resorts were more focused on tourism, while newer resorts built under current land use rules include more single family homes. The county’s resort study should not rely solely on data from old resorts, such as Sunriver and Black Butte Ranch, but should also look at newer resorts such as Eagle Crest, Kancler said.

“There’s a specific set of rules that allow certain developments that we, and others, have criticized as golf course subdivisions,” Kancler said. He added that the county commissioners should commit to using the study’s results as a basis for their land use policy decisions.

Alana Audette, president and CEO of Central Oregon Visitors Association, said she hopes to participate in the focus groups but is not sure whether her schedule will permit her to do so this week, and she is concerned other members of the tourism industry might be too busy to participate during the summer season.

Reliable study results depend upon having participants who represent a range of interests, Audette said, and it could be difficult for owners and operators of small businesses to devote time to the groups at the height of the summer tourism season.

Hillary Borrud can be reached at 541-617-7829 or at hborrud@bendbulletin.com.